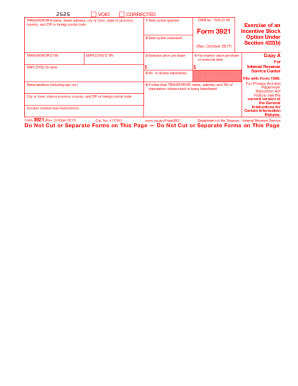

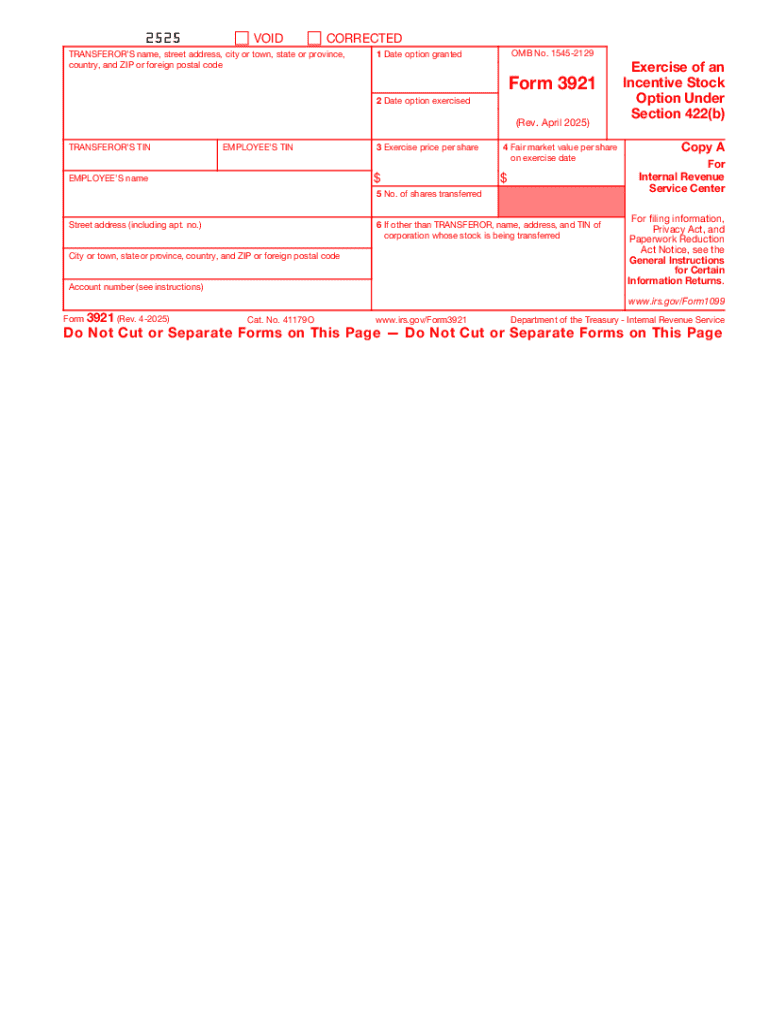

IRS 3921 2025-2026 free printable template

Instructions and Help about IRS 3921

How to edit IRS 3921

How to fill out IRS 3921

Latest updates to IRS 3921

All You Need to Know About IRS 3921

What is IRS 3921?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3921

What should I do if I find an error on my IRS 3921 after submission?

If you discover an error on your IRS 3921 after it has been submitted, you can submit an amended form to correct the mistake. Ensure you clearly indicate which parts are corrected and provide any necessary explanations. Keep records of both the original and amended submissions for your documentation.

How can I track the status of my submitted IRS 3921?

To track the status of your submitted IRS 3921, you can use the IRS online tools for tracking filings or check with the service through which you filed. If you e-filed, you may also receive notifications about the processing of your form, including any potential issues.

What should I do if my e-filed IRS 3921 gets rejected?

In case your e-filed IRS 3921 is rejected, review the rejection codes provided to identify the issue. Correct any errors indicated and resubmit the form promptly to avoid delays in processing. Document the steps taken to rectify the situation for your records.

What privacy measures are needed when filing IRS 3921 electronically?

When filing IRS 3921 electronically, it is important to ensure that personal and sensitive information is transmitted securely. Use e-filing platforms that comply with IRS data security standards and consider encrypting sensitive data to protect against unauthorized access.

How do service fees affect my e-filing of IRS 3921?

Many e-filing services may charge fees for processing IRS 3921 submissions. Make sure to review these fees in advance and factor them into your budget. Additionally, inquire about refund policies if your submission is rejected or if you encounter any issues.